Key Deadlines and Smart Moves Before December 31, 2025

As 2025 draws to a close, now is a good time to pause and make sure your financial life is organized, optimized, and aligned with your goals. Year-end is often your chance to take advantage of valuable tax and planning opportunities before the clock resets on January 1.

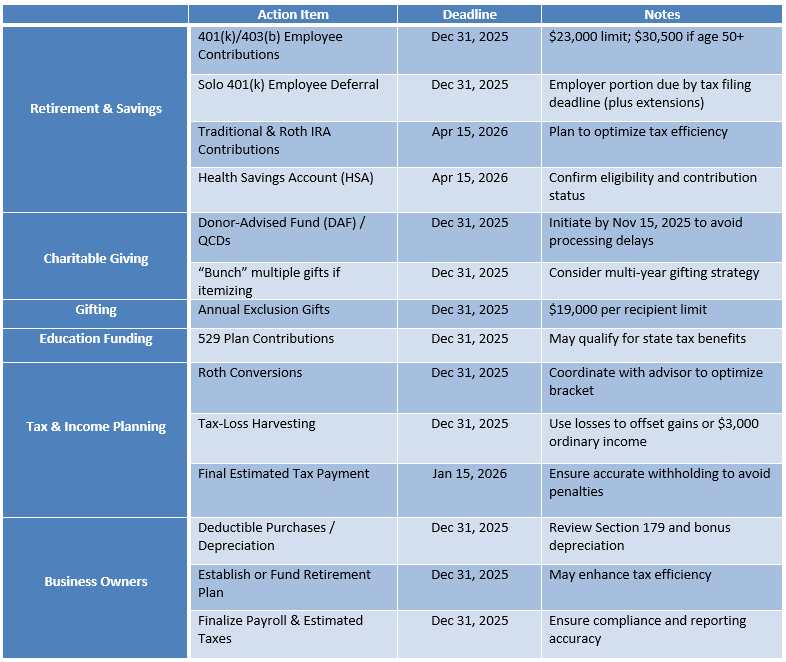

To help you stay on track, our team at Shepherd Financial Partners has compiled a concise checklist of items to review.

Important Year-End Deadlines

Retirement & Savings Contributions

- 401(k) & 403(b) Employee Contributions must be made by December 31, 2025.

2025 limits:- $23,000 (under age 50)

- $30,500 (age 50+ catch-up)

- Solo 401(k) Contributions for Self-employed Individuals deferrals are due by December 31, 2026; employer contributions can generally be made up to your tax-filing deadline (plus extensions).

- Traditional & Roth IRA Contributions can be submitted up until April 15, 2026, but it’s wise to plan funding now to optimize your tax position.

- HSA Contributions can be made until April 15, 2026, but confirm that you remain HSA-eligible for the year.

Charitable Giving

- Donor-Advised Fund (DAF) contributions and qualified charitable distributions (QCDs) from IRAs must be completed by December 31, 2025 to count for 2025 taxes.

- To avoid delays in processing, we recommend that year-end charitable contributions be initiated by November 15, 2025.

- Consider “bunching” multiple years of gifts into a single year if you itemize deductions.

Gifting

- Gift tax exclusion for 2025 is $19,000 per recipient. You will have until December 31, 2025 to make your 2025 gifts.

Education Funding

- 529 Plan Contributions could be subject to tax deductions or credits from your state if contributions are made by December 31, 2025.

Tax & Income Planning

- Roth Conversions must be completed by December 31, 2025.

- Tax-loss Harvesting: Realize investment losses before year-end to offset gains or up to $3,000 of ordinary income.

- Estimated Tax Payments final 2025 quarterly payment is due January 15, 2026.

- Review your withholding to avoid underpayment penalties.

Business Owners

- By December 31, 2025, a number of finances should be in order:

- Quarterly estimated taxes and payroll filings are up to date.

- Year-end purchases for deductible expenses are finalized.

- Depreciation elections (e.g., Section 179 or bonus depreciation) have been reviewed.

- Retirement plan funding or setting up a new plan should be completed.

Good Practices as the year ends

Year-end is generally a time for reflection and planning for the coming new year. The same can be applied to your financial life. Below are six areas to review as we head into 2026:

- Review Your Financial Goals: Check progress on 2025 goals—savings targets, debt reduction, portfolio allocations—and recalibrate for 2026.

- Confirm Beneficiaries and Estate Documents: Verify that your beneficiary designations (on retirement accounts, insurance, and TOD accounts) are current and consistent with your estate plan.

- Maximize Tax-Advantaged Accounts: Don’t overlook FSAs, dependent care accounts, and HSAs—some have “use it or lose it” provisions.

- Review Insurance Coverage: Check health, life, disability, and property policies for adequate coverage and beneficiary accuracy.

- Plan for Major 2026 Changes: If your income, business, or family situation will change in 2026 (retirement, sale, relocation, etc.), coordinate with your advisor now to prepare.

- Organize for Tax Season Early: Gather charitable receipts, capital-gain statements, and major purchase documents before the new year begins.

Your Team at Shepherd is here to help

The end of the year can be busy—but it is also one of the most valuable times to plan thoughtfully. If you would like us to review your portfolio, tax strategy, or charitable giving plan before year-end, please reach out to your team at Shepherd Financial Partners to review your strategic plan and any actions that need to be taken.

As always, please reach out to us with any questions.

📅 Key Year-End Deadlines

Disclosures

Shepherd Financial Partners and LPL Financial do not provide specific individualized tax advice. We suggest that you discuss your specific situation with a qualified tax advisor.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Tracking #: 823518