Each year, the IRS sets the maximum that you can contribute to your retirement plan. Effective January 1, 2026, the IRS has increased certain limits for company retirement plans. These adjustments are driven by inflation and cost-of-living indexing and give savers more room to build their nest eggs.

Notably, those turning 60-63 by the end of the 2026 calendar year will again have the opportunity to contribute even more to their retirement plan because of a provision of SECURE 2.0 ACT enacted in 2025. This specific change will only apply to those turning 60-63 in 2026 and are enrolled in 457(b), 401(k), 403(b), or SIMPLE plans. This will not impact those with IRA/Roth IRA accounts.

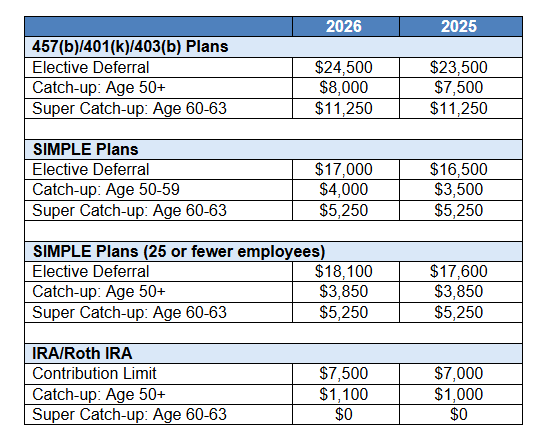

There are additional changes that will take place beginning in 2026. See below for summaries and limits on on certain plans:

401(k), 403(b) and 457(b) Plans

As of January 1, 2026, the IRS has raised the contribution ceilings for several common retirement accounts. These adjustments — driven by inflation and cost-of-living indexing — give savers more room to build their nest eggs.

- The standard elective deferral limit rises to $24,500 (up from $23,500 in 2025).

- For those aged 50+, the “catch-up” contribution limit is now $8,000 (up from $7,500).

- If you’re between age 60–63, and your plan allows, the “super catch-up” remains at $11,250.

- That means a 50+ saver could put up to $32,500 into a 401(k), and a 60–63-year-old could potentially contribute up to $35,750 (when including the “super” catch-up). For those who are eligible, the increased catch-up allowance creates a meaningful opportunity to boost retirement savings.

- Of Note: Beginning in 2026, all catch-up contributions must be Roth (after-tax) rather than traditional pre-tax, depending on income and employer plan rules.

SIMPLE Plans (SIMPLE IRA / SIMPLE 401(k))

For small-employer retirement plans, contributions are increasing too:

- Companies with 25+ employees:

- The standard 2026 elective deferral limit is $17,000 (up from $16,500 in 2025).

- For those age 50 or older, the catch-up limit rises to $4,000 (from $3,500).

- This year, both the super catch-up and 50+ catch-up remain the same as last year ($3,850 for 50+ catch-up and $5,250 for super).

- Companies with fewer than 25 employees:

- The standard elective deferral limit is $18,100

- This year, both the super catch-up and 50+ limit remain the same as last year at ($3,850 for 50+ catch-up and $5,250 for super).

Traditional & Roth IRAs

- The standard contribution limit rises to $7,500 in 2026 (from $7,000 in 2025).

- For savers age 50 or older, the catch-up contribution increases to $1,100 (up from $1,000), bringing the total possible contribution to $8,600.

- There is no “super catch-up: for those ages 60-63 with IRAs.

- That limit applies to all your IRAs combined, traditional and Roth.

See the table below for contribution limits for 2026 and 2025.

Please reach out to your advisor or your Shepherd Financial Partners team with any questions or to discuss options today.

Source: IRS

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Source: IRS

Tracking #: 834924