Global stock markets have been setting new all-time highs in recent weeks. New highs within markets often lead to concerns about the potential for pullbacks, prompting us to address our investment strategies in such environments. Market highs and corrections are both natural phases of investing, and both periods offer valuable opportunities for long-term investors. At Shepherd Financial Partners, we anchor investment decisions around your personalized financial plan to remain disciplined through periods of new highs and volatility.

Investing at Market Highs

Markets achieving new highs is a common occurrence and signals the ongoing growth that rewards disciplined investment. Historical data demonstrates that investing at market highs does not inherently place individuals at a disadvantage, nor does it indicate an approaching decline. On average, the market achieves new all-time highs 16 times per year, and approximately two-thirds of years feature at least one all-time high. Remaining consistently invested and making regular contributions can provide continued participation in long-term market growth. Dollar cost averaging—making systematic investments over time—can be highly effective in these environments, helping to smooth out the impact of short-term movements and maintain momentum toward financial goals. Sitting on the sidelines with cash to time the market rarely proves to be a successful strategy, as predicting short-term movements is extremely difficult and often results in missed opportunities.

Navigating Market Corrections

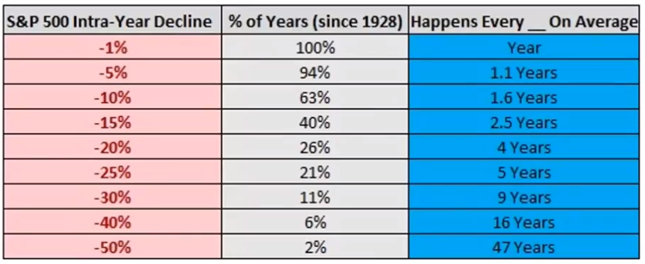

Market corrections, while often unsettling, are not anomalies. In fact, intra-year declines of 5% or more occur almost every year, and a 10% decline happens in nearly two out of every three years. More substantial corrections, such as bear markets, are less frequent yet still part of the normal market cycle: a 20% decline occurs on average every four to five years, while a 30% drop occurs roughly once every nine years (1928 to present). 1

When markets are in a correction, we typically consider the merits of lump sum investing over dollar cost averaging. We also recommend other proactive activities such as rebalancing, tax loss harvesting, and opportunistically seeking investments that are on sale. Historically, markets have rebounded from corrections, and investing during these periods can position portfolios favorably for long-term recovery and growth.

Importance of Following Your Financial Plan

The most consistent approach amid both new highs and market corrections is to align investment decisions with the financial plan that you created alongside your advisor. A tailored plan accounts for personal goals, risk preferences, and time horizons, ensuring that actions taken today can help build towards your long-term financial well-being, regardless of where the market stands. Market movements are frequent and should be expected; having a proactive approach means every stage of the cycle is navigated with clarity and purpose.

Below are examples of how we align client portfolios with their financial plan and unique needs or circumstances:

- For the long-term investor within the accumulation phase, we are generally aligned to a risk-on allocation to take advantage of the client’s long time-horizon and ability to benefit from compounding returns. We remain diversified across sectors, regions and market caps because these areas typically do not move in exactly the same cycles. We also gain exposure to risk assets outside of the stock market, whether through commodities, real estate or other alternative investments to improve diversification. During volatility, we seek opportunities to continue executing on savings plans and proactively rebalancing portfolios to attractive areas of the market.

- For clients within the distribution phase, the portfolio design shifts to manage cash flow needs and buffer against declines that can impact distribution plans. By utilizing a client’s financial plan, we understand their cash flow needs and customize the portfolio to deliver income and hold lower-risk investments such as fixed income to serve as a source of cash flow during times of market volatility. Each portfolio is constructed with the client’s individual plan in mind.

Market Volatility: A Vital Feature

The historical data on intra-year declines clearly shows that market volatility has been present year after year. This volatility creates opportunities for disciplined investors and highlights the importance of regular review and engagement with a financial advisor.

At Shepherd Financial Partners, our priority is to help clients confidently navigate all market conditions, using disciplined strategies and a deep commitment to their long-term financial well-being.

Source: @BespokeInvest

Sources:

- YCharts

- @BespokeInvest

Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All indices are unmanaged and may not be invested into directly.

Dollar cost averaging involves continuous investment in securities regardless of fluctuation in price levels of such securities. An investor should consider their ability to continue purchasing through fluctuating price levels. Such a plan does not assure a profit and does not protect against loss in declining markets.

Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

The fast price swings in commodities will result in significant volatility in an investor’s holdings. Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors.

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

The content is developed from sources believed to be providing accurate information.

Tracking #: 811884-1

- YCharts ↩︎