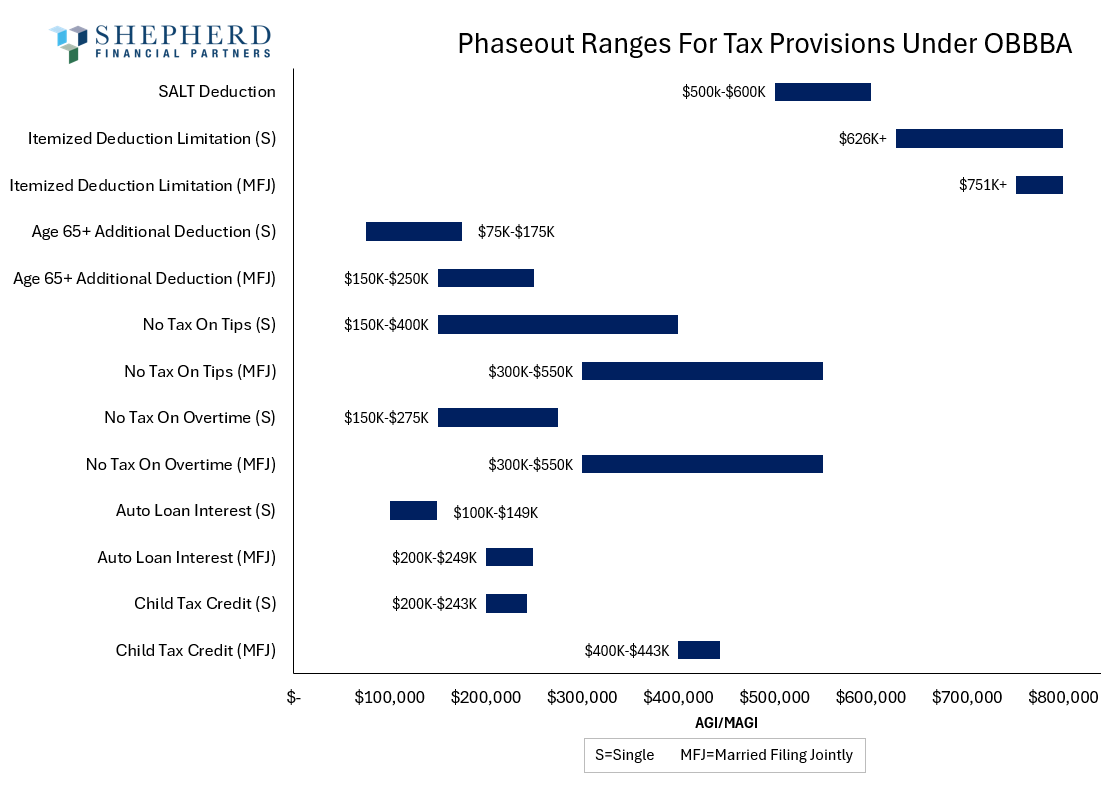

And a helpful chart

The OBBBA incorporates several new and modified tax provisions that include income-based phaseout limits.

A phaseout limit is a tax policy mechanism that reduces or eliminates a tax benefit as a taxpayer’s income rises. Your qualification for each of these provisions depends on how you file—single, head of household, married filing jointly (MFJ), or married filing separately—and your modified adjusted gross income (MAGI).

This chart reflects each specific deduction and its limit. We have summarized each for you below.

SALT (State and Local Taxes)

For tax year 2025, the SALT deduction cap is increased to $40,000 for single and joint filers, and $20,000 for married filing separately.

The expanded cap applies in full to those with MAGI up to $500,000. Above these thresholds, the deduction phases out and reverts to $10,000 for incomes over $600,000. Other restrictions may apply.

Itemized Deduction Limitation

Starting in 2026, there is a new limitation on itemized deductions for high-income taxpayers. The new rule, which applies to taxpayers in the top 37% Federal tax bracket (those with taxable income above $626,350 for single or $751,600 for joint filers), effectively caps the itemized deduction benefits for these taxpayers to 35%.

Age 65+ Additional Deduction

The OBBBA adds a new deduction of $6,000 per eligible individual over 65 years old ($12,000 for a married couple where both are 65+) that is available from 2025 through 2028.

This bonus deduction begins to phase out above a MAGI of $75,000 single and $150,000 MFJ. These deductions do not apply for MAGIs above $175,000 single and $250,000.

No Tax on Overtime or Tips

Between 2025 and 2028, there will be a temporary deduction for qualified overtime compensation of $12,500 single and $25,000 MFJ. Phaseouts begin for single filers at $150,000 and $300,000 MFJ. For every $1,000 above MAGI, the deduction is reduced by $100. These deductions do not apply for MAGIs above $400,000 single and $550,000 MFJ.

Also between 2025-2028, those who earn tips at their place of employment can also receive a tax deduction capped at $25,000 per year per taxpayer. This begins to decrease for those with a MAGI over $150,000 single and $300,000 MFJ. The deduction is reduced by $100 for every $1,000 of MAGI above these thresholds. These deductions do not apply for MAGIs above $400,000 single and $550,000 MFJ. (Note: these tips will still be subject to Social Security and Medicare payroll taxes.)

Auto Loan Interest

Eligible taxpayers who purchase a new car manufactured in the U.S. can deduct up to $10,000 in car loan interest on vehicles purchased between 2025 and 2028. The deduction begins to phase out at $100,000 MAGI single and $200,000 MFJ. These deductions do not apply for MAGIs above $149,000 single and $249,000 MFJ.

Child Tax Credit (CTC)

The maximum child tax credit for the 2025 tax year is $2,200 per qualifying child and will be indexed for inflation in 2026. The CTC begins to phase out for single and HOH filers with a MAGI over $200,000 and $400,000 MFJ. The credit is reduced by $50 for every $1,000 of MAGI above these thresholds from the total they would receive for all children in total. These deductions do not apply for MAGIs above $243,000 single and $443,000 MFJ.

Please do not hesitate to reach out to us with any questions!

Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

Investment advice offered through Shepherd Financial Partners, LLC. A registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities. Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 796289