Following a failure to agree upon a short-term measure to fund the government through November 21, the lapse in funding has triggered a government shutdown. While these events often dominate the headlines, they are not new. Since 1976, the federal government has experienced more than 20 shutdowns, ranging in length from just one day to over a month. The most recent and longest shutdown, in late 2018 to early 2019, lasted 35 days.

What Happens in a Shutdown?

When Congress is unable to agree on funding legislation, many parts of the federal government temporarily shut down. Federal agencies must stop all “nonessential” operations, while essential services continue. During this period, federal employees who cease work are furloughed without pay during the shutdown. “Essential” employees who continue working do so without pay until the shutdown ends. The White House Office of Management and Budget dictates the process of instructing which agencies are to cease operations. A preliminary memo was issued last night that expressed more details will come on which agencies will shut down.

Here is a breakdown of what typically happens:

- Continues as normal:

- Social Security, Medicare, and Medicaid benefits

- The U.S. Postal Service (mail delivery)

- Air traffic control and TSA screenings

- Military operations and national security functions

- Federal Reserve and financial regulatory agencies

- Temporarily paused or reduced:

- National parks, museums, and monuments (often closed or restricted)

- Many federal employees are furloughed without pay (though historically paid retroactively once the shutdown ends; a practice passed into law in 2019).

- Certain government services such as passport processing, small business loan approvals, and IRS functions, may be delayed.

- Some federal contracts and research grants may be suspended.

Economic Impact

The overall economic impact of a shutdown depends on its length. Short shutdowns often have minimal effects, while longer ones can temporarily slow growth.

- According to Congressional Budget Office estimates, the 2018–2019 shutdown reduced GDP growth by 0.1% per week it lasted, though much of that was recovered once government reopened.

- Federal employees missing paychecks can temporarily reduce consumer spending.

- Businesses that rely on federal permits, loans, or approvals may experience delays.

- Investor sentiment can be unsettled, leading to short-term market volatility.

Importantly, the long-term impact has historically been limited. Once the government reopens, economic activity and spending generally catch up.

Historical Market Reaction

Market performance during past shutdowns has been mixed. Vanguard analysis shows that:

- Stocks rose during roughly half of all shutdown periods and declined in the other half.

- The average return during shutdowns since 1976 was slightly negative, but the variation was wide and inconsistent. Given the large dispersion, our view is that broader trends in the economy and corporate earnings continue to drive markets during and through a shutdown rather than the shutdown itself given the relatively short-term nature of these events.

- In the months following a shutdown, markets have tended to recover, underscoring that these events have not been reliable predictors of long-term investment performance.

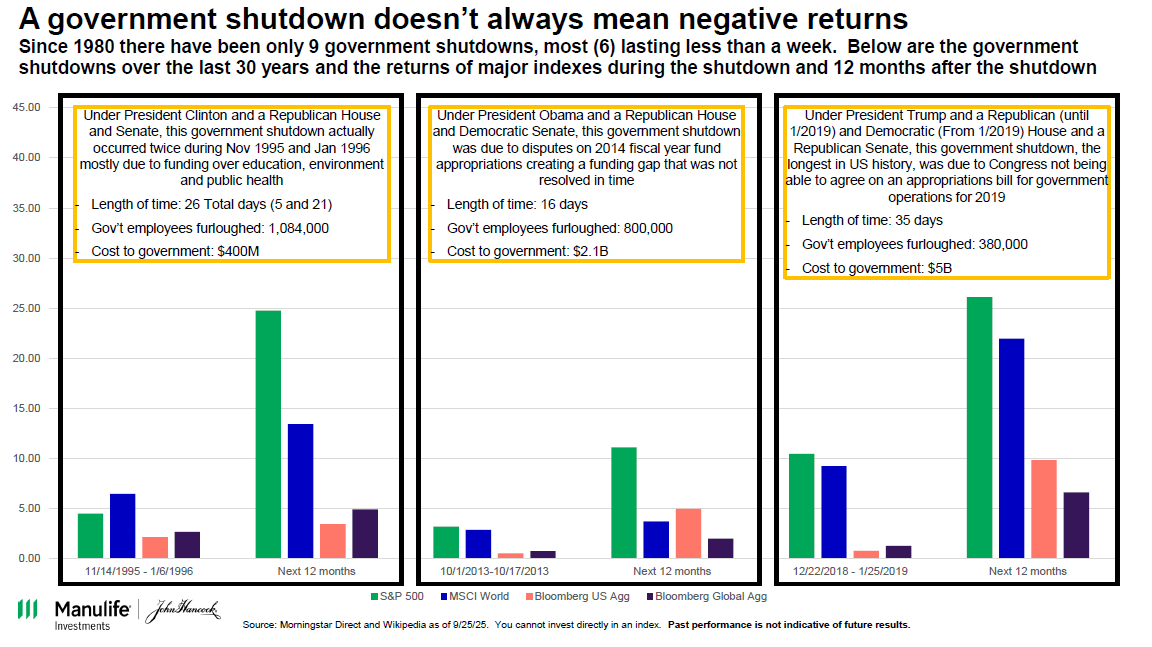

- The chart below shows the market reaction to the three longest shutdowns over the last 40 years. As you can see, during these longer periods, markets were actually positive during the course of the shutdown (source John Hancock).

The average return during shutdowns since 1976 was slightly negative, but the variation was wide and inconsistent. Given the large dispersion, our view is that the broader trends in the economy and corporate earnings continue to drive markets during and through a shutdown rather than the shutdown itself given the relatively short-term nature of these events.

What This Means for Your Financial Plan

For most, shutdowns can cause inconvenience and short-term uncertainty, but they do not alter the foundation of your financial plan. That being said, on an individual basis, federal employees who may be furloughed without pay can see immediate impacts on their personal financial situations. At Shepherd Financial Partners, we believe the best approach is to:

- Take stock of your plan. If you are impacted by the shutdown, please reach out to your advisor to review your plan and see how a shutdown may impact your near-term cash flow. Even if you are not directly impacted, these events are always good moments to reflect upon your own plan and take stock of what you may need to do in the event of temporary loss of income: review your cash flow, emergency funds, and goals for large expenses.

- Maintain perspective. Shutdowns are temporary. History shows they pass, and do not alter current economic trends. As we have discussed frequently in the past, we do not react to short-term political or geopolitical events within our investment process, rather we focus on the long-term and aligning your portfolio to your financial plan.

- Focus on your goals. Your financial plan is built around your objectives, time horizon, and needs—not day-to-day political developments.

While government shutdowns may capture news attention, they should not derail your confidence in your long-term plan. We are here to help you filter out the noise and stay focused on what matters most: pursuing your financial goals. As always, please reach out to your team at Shepherd Financial Partners if you would like to discuss what this shutdown means for you.

Source: John Hancock and Manulife Investments

It is not possible to invest directly in an index.

- The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States.

- The MSCI World (Net) Index is a free float adjusted market capitalization weighted index that tracks global developed market equity performance, net of foreign withholding tax.

- The Bloomberg U.S. Aggregate Bond Index tracks the performance of U.S. investment grade bonds in government, asset backed, and corporate debt markets.

- The Bloomberg Global Aggregate Bond Index tracks the performance of global investment grade debt in fixed rate treasury, government related, corporate, and securitized bond markets.

Disclosures

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investment advice offered through Shepherd Financial Partners, LLC, a registered investment advisor. Registration as an investment advisor does not imply any level of skill or training.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Securities offered through LPL Financial, member FINRA/SIPC. Shepherd Financial Partners and LPL Financial are separate entities.

Additional information, including management fees and expenses, is provided on Shepherd Financial Partners, LLC’s Form ADV Part 2, which is available by request.

Tracking #: 805112